Accelerate Deal Velocity

From Intake to Underwriting

Your time is best spent on relationships, not document review.

Schedule a discovery call

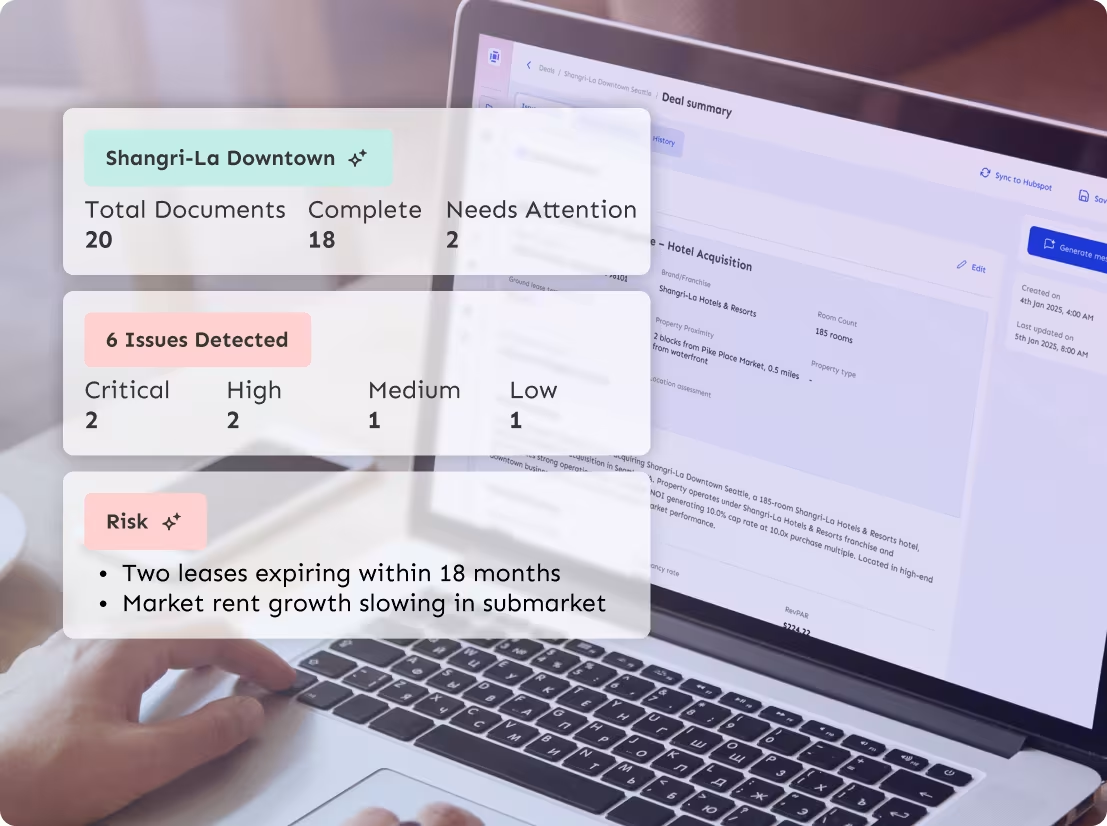

AI assistant designed for loan originators, helping you validate deals, summarize complex deals instantly, and ensure every file is ready for credit without slowing you down.

Accelerate your lending operations with Intelligent Automation

LenderIQ’s commercial lending suite brings purpose-built AI agents with native financial intelligence and plug-and-play UIs, empowering you to

Process more deals

Automate initial document review and validation to handle higher deal volumes.

Reduce operational friction

Ensure data is complete upfront to hand off deals with confidence and avoid process bottlenecks.

No new tools to learn

Integrate with the tools you already rely on like Google Drive, Dropbox, and your CRM to start scaling immediately.

Seamless AI experience

Seamlessly integrated into your process

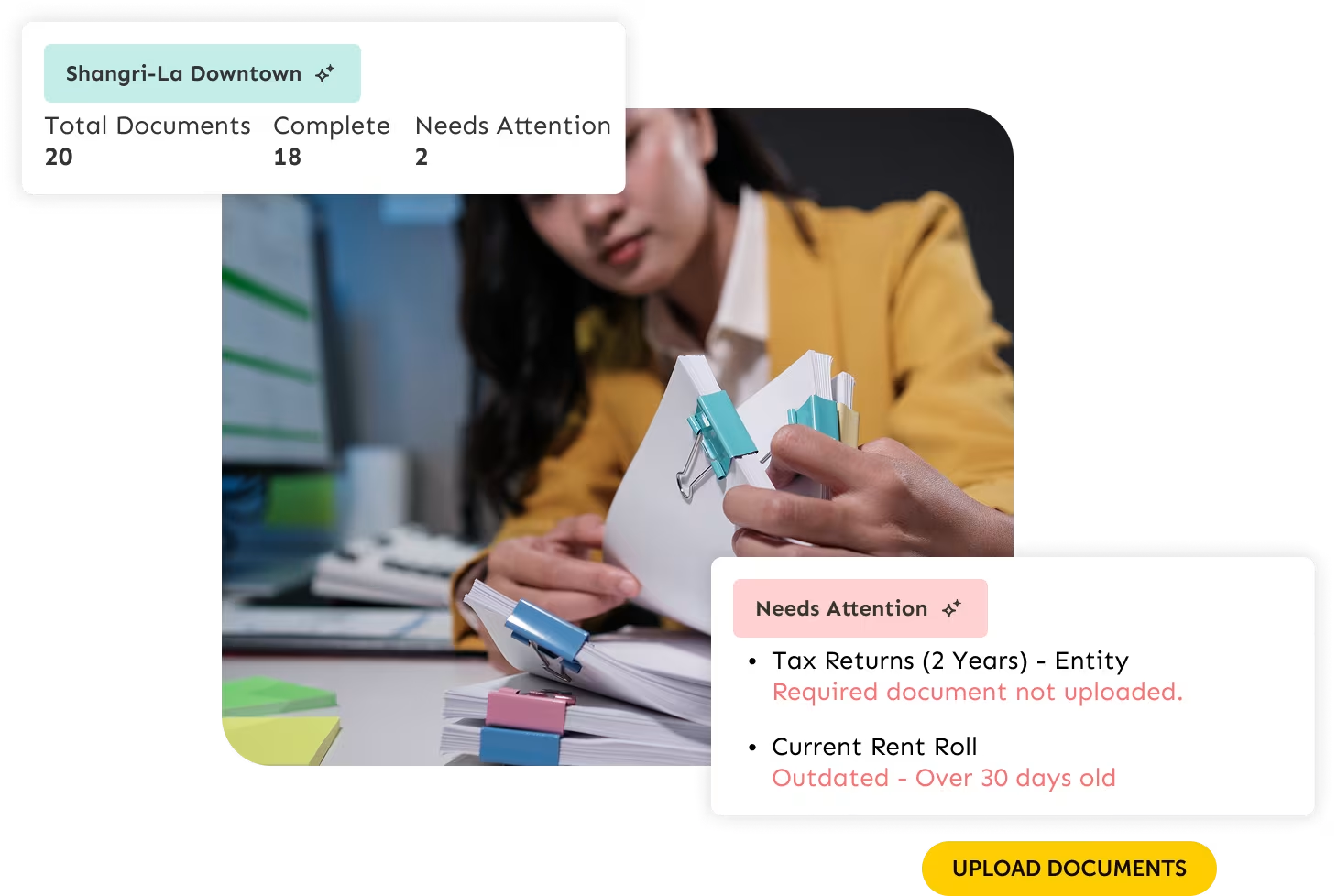

1. Upload

Drop the deal folder directly into the application or from storage platforms like Google Drive and Dropbox.

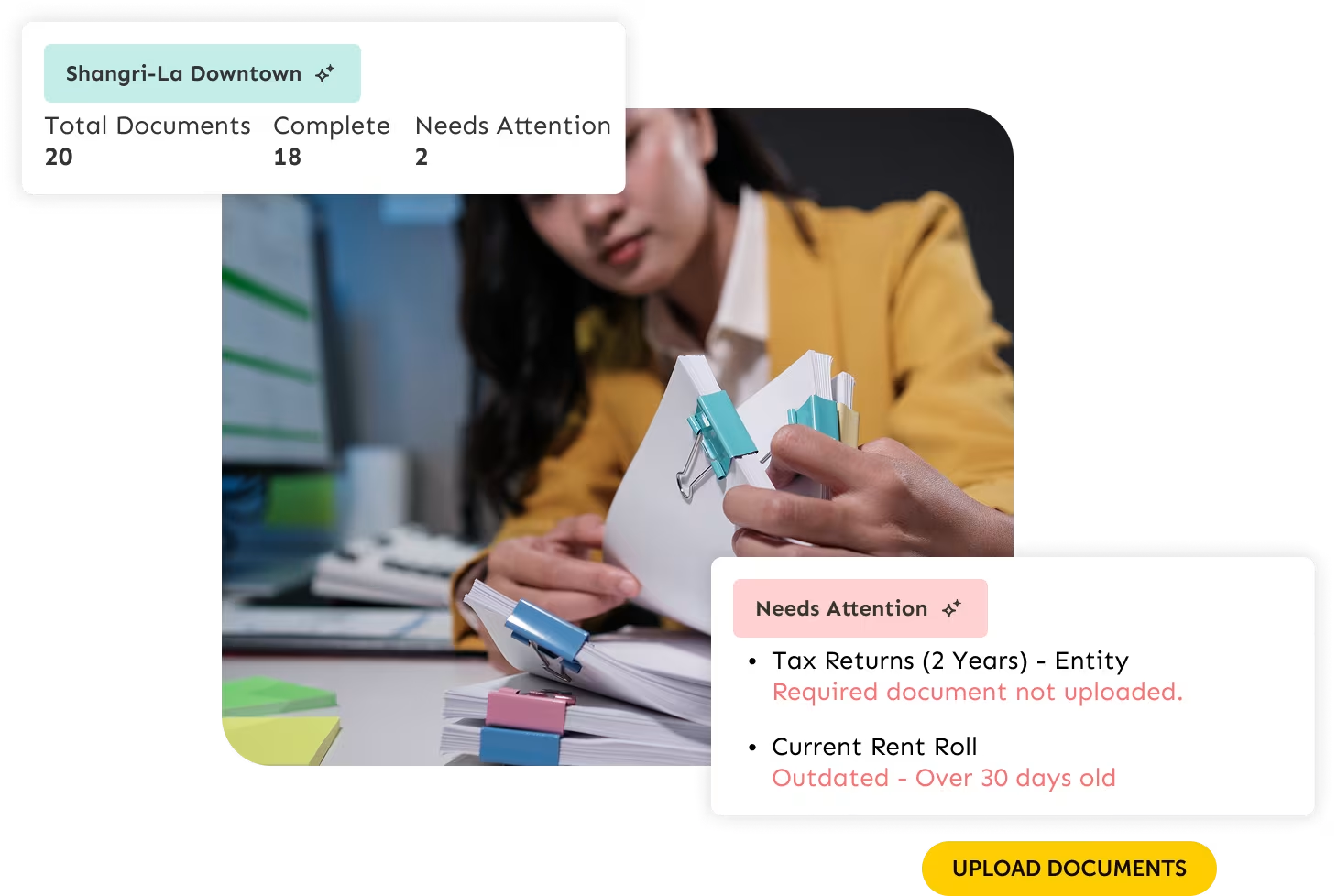

2. Verify

LenderIQ validates the package for completeness.

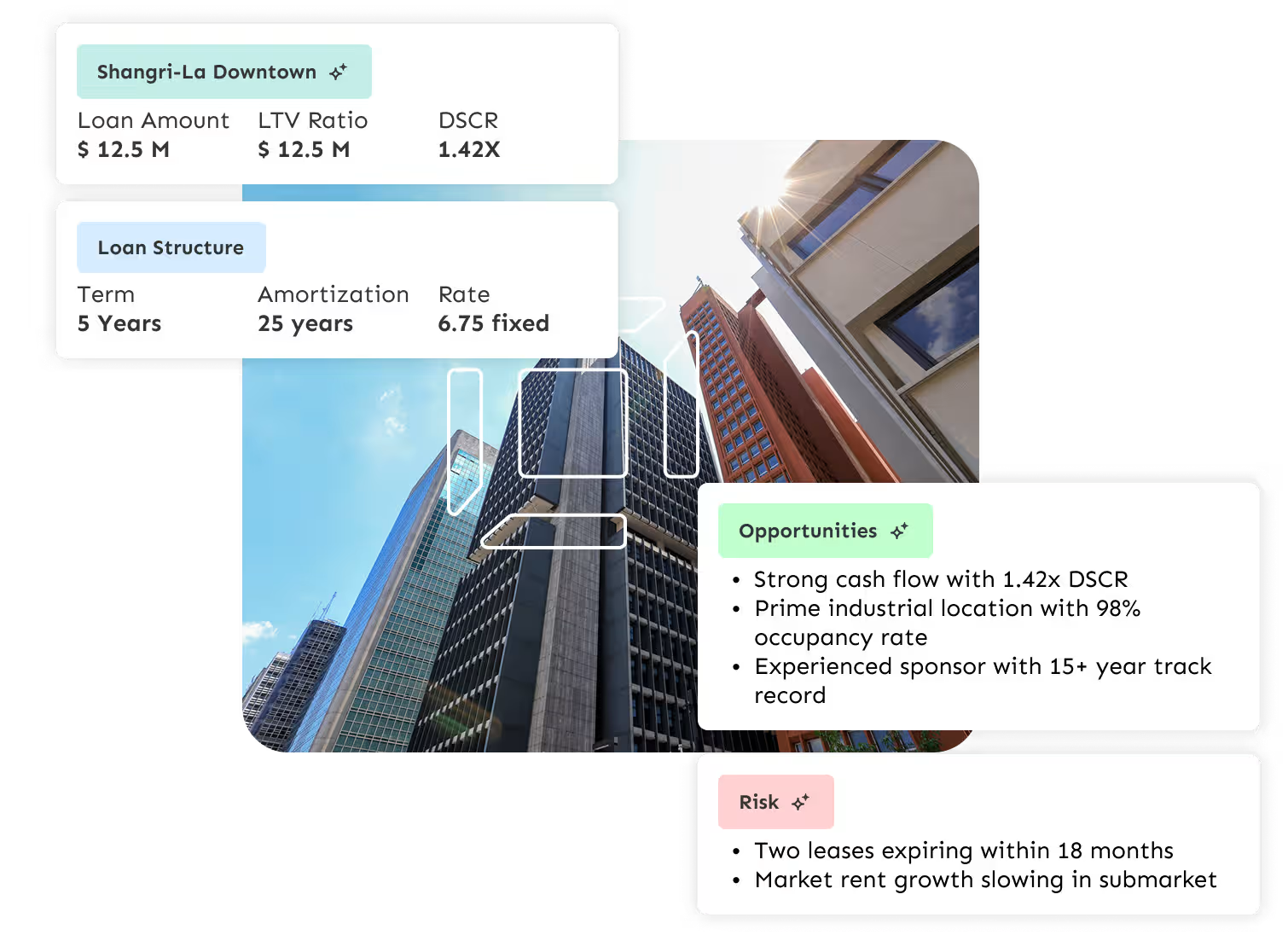

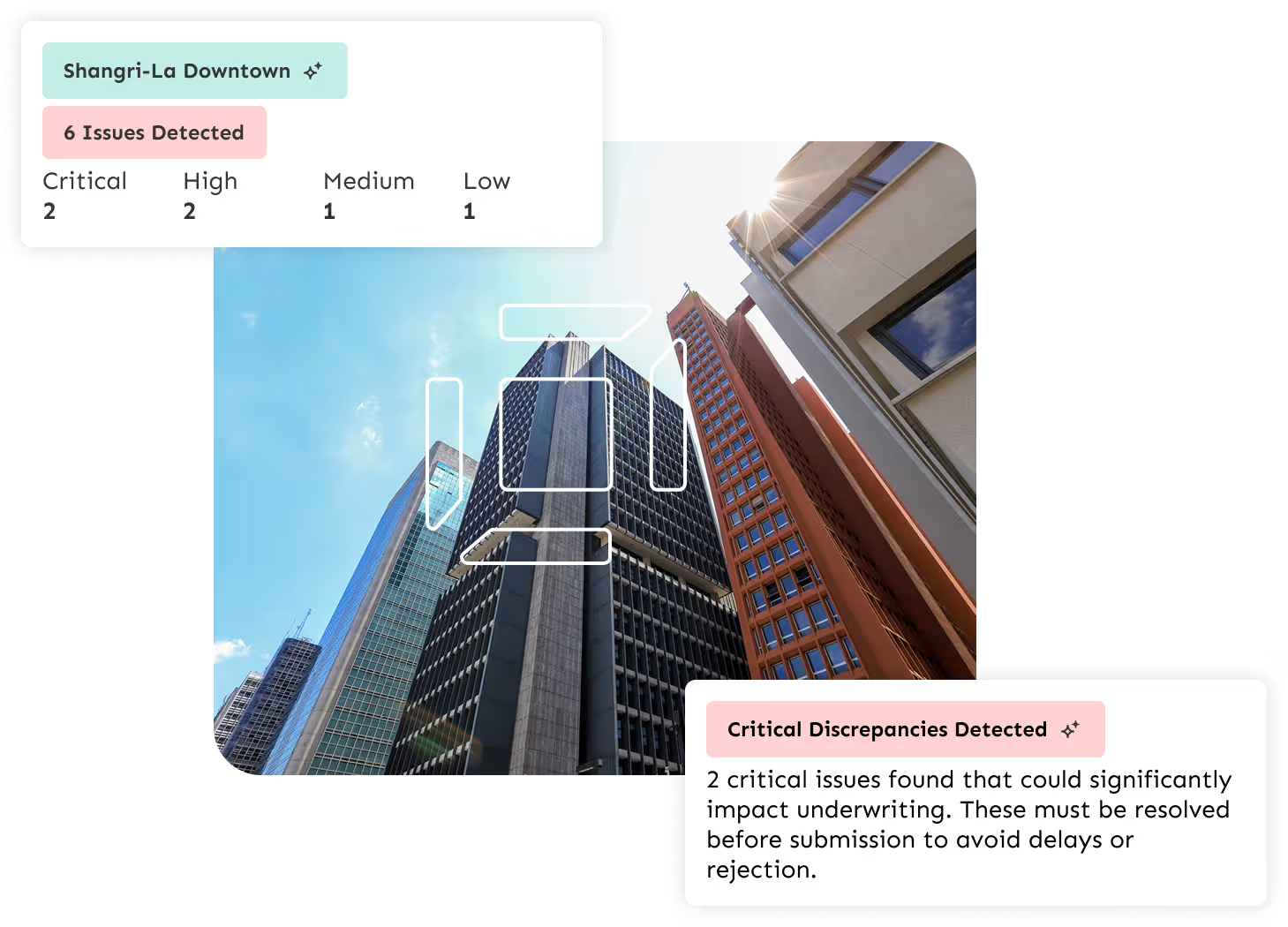

3. Analyze

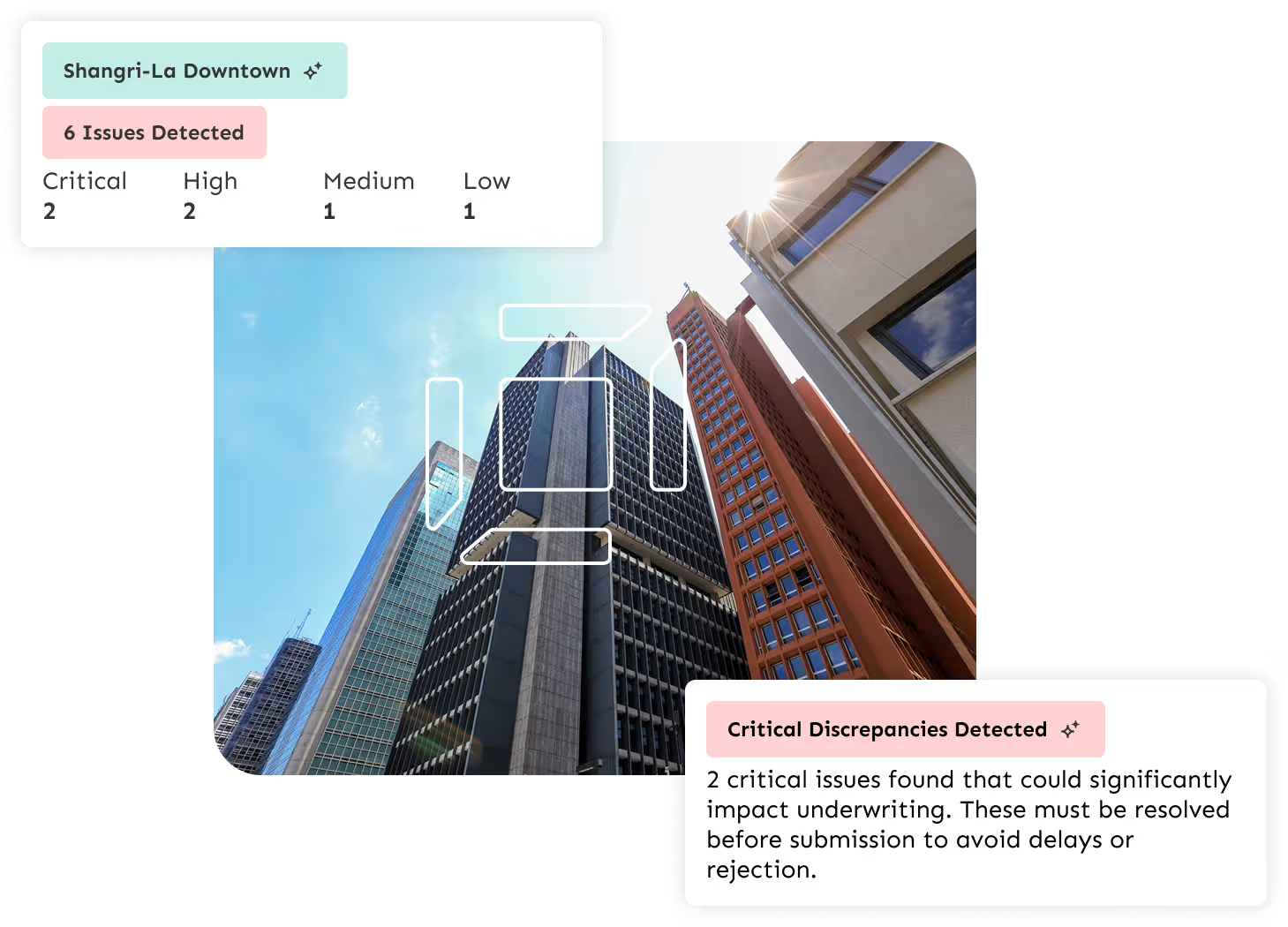

The AI generates a comprehensive summary and spots discrepancies.

4. Resolve

Automatically generate emails to brokers to fill data gaps.

Solve the origination bottleneck

Eliminate the friction caused by messy deal submissions and incomplete data.

Stop manual reviews

Stop digging through PDFs to extract basic deal metrics, which takes time away from new business.

End the "Kickback" loop

Avoid sending deals to credit only to have them returned for missing docs and incomplete information.

Remove communication lag

Stop slowing down deal momentum by drafting detailed emails about missing items manually.

Built for the modern loan origination team

Purpose-built for commercial real estate originators, credit managers, and operations leaders that:

Need to move fast by spotting data discrepancies like rent roll vs. lease mismatches before they stall the deal.

Want to eliminate the "kickback loop" ensuring files are complete and validated before handing off to underwriting.

Seek to scale pipeline velocity without getting bogged down acting as "document chasers" for missing info.

Require immediate ROI through a lightweight solution that integrates with current tools without disrupting workflows.

Accelerate your pre-underwriting origination process

Let LenderIQ handle the document details so you can focus on the borrower.

Schedule a discovery call